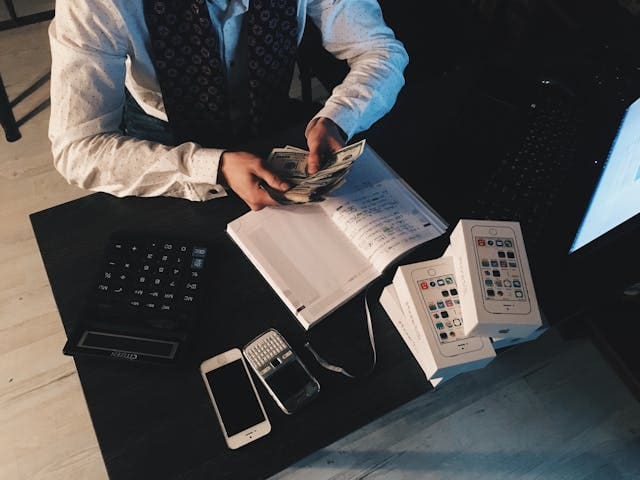

Money laundering is a serious financial crime that allows criminals to conceal illicit funds, posing risks to the global financial system. While detecting these violations may be challenging, whistleblowers play a pivotal role in exposing hidden crimes. If you have information about money laundering activities, it’s essential to understand your rights and how to report it safely. This article explains how reporting these violations can make a difference, how whistleblower protections work, and the vital role legal representation plays in the process.

What is Money Laundering and Why Does it Matter?

Money laundering refers to the process of making illegally gained money appear legitimate. Criminals engage in money laundering to hide the origins of illicit funds, which may have been generated through illegal activities such as drug trafficking, fraud, or corruption. The consequences of money laundering are far-reaching, as it enables criminal networks to expand and poses significant threats to the economy, public trust, and national security.

Under U.S. law, financial institutions are required to comply with anti-money laundering (AML) regulations to detect and prevent such activities. These regulations require financial institutions to file Suspicious Activity Reports (SARs) when they identify transactions that might be related to illegal activities, such as money laundering.

Why Whistleblowers are Key to Combating Money Laundering

Whistleblowers are essential in the fight against money laundering because they often have access to confidential information that can reveal illicit activities within financial institutions. Reporting these violations can help authorities stop criminal operations and ensure that those responsible face legal consequences.

U.S. law provides strong protections for whistleblowers who report money laundering violations. The Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) and the Dodd-Frank Act reward whistleblowers with up to 30% of the total monetary recovery from successful enforcement actions. These protections also ensure whistleblowers are shielded from retaliation by their employers, offering them job security and confidentiality.

How Legal Representation Helps Whistleblowers

Reporting money laundering is a serious matter that requires legal expertise. An AML Whistleblower attorney can provide the guidance needed to ensure that your report is legally sound and that you follow the necessary steps to protect your rights. A qualified attorney will assist in gathering and presenting evidence, ensuring that your information is correctly submitted to authorities like FinCEN, the DOJ, or the SEC.

Legal representation also helps maximize the potential financial reward by ensuring the whistleblower fulfills all the legal requirements for eligibility. Without an attorney, whistleblowers may struggle to navigate the complex laws and procedures involved in the reporting process.

The Process of Reporting a Money Laundering Violation

If you suspect a money laundering violation, here are the key steps involved in reporting it:

- Identify the Violation: Look for red flags such as suspicious transactions, inadequate Know Your Customer (KYC) practices, or unusual account activity.

- Gather Evidence: Secure all relevant documentation, including transaction records, emails, or internal reports that support your claim of money laundering.

- File a Report: Submit your report to the appropriate authority, such as FinCEN, the DOJ, or the SEC. A lawyer can help you decide the right agency based on the nature of the violation.

- Maintain Confidentiality: Your attorney will ensure your identity remains protected throughout the process, which is especially important if you work within the institution involved.

What to Expect as an AML Whistleblower

Whistleblowers who report money laundering violations and lead authorities to a successful investigation may be entitled to a reward. If the violation results in a financial recovery, whistleblowers could receive up to 30% of the recovered amount, depending on the circumstances.

Whistleblowers also receive strong protections under the law. Retaliation against whistleblowers is illegal, and your attorney can help defend your rights if you face any challenges. It’s essential to have legal representation throughout the process to safeguard your future.

Conclusion

Reporting money laundering is a critical step in safeguarding the financial system, and whistleblowers play a key role in stopping criminal activity. Working with a skilled AML Whistleblower attorney ensures that your report is legally sound, your identity is protected, and your rights are defended. If you have valuable information regarding money laundering violations, consult with an attorney today to understand your options and begin the reporting process.

The New Jersey Digest is a new jersey magazine that has chronicled daily life in the Garden State for over 10 years.

- Staffhttps://thedigestonline.com/author/thedigeststaff/

- Staffhttps://thedigestonline.com/author/thedigeststaff/

- Staffhttps://thedigestonline.com/author/thedigeststaff/

- Staffhttps://thedigestonline.com/author/thedigeststaff/