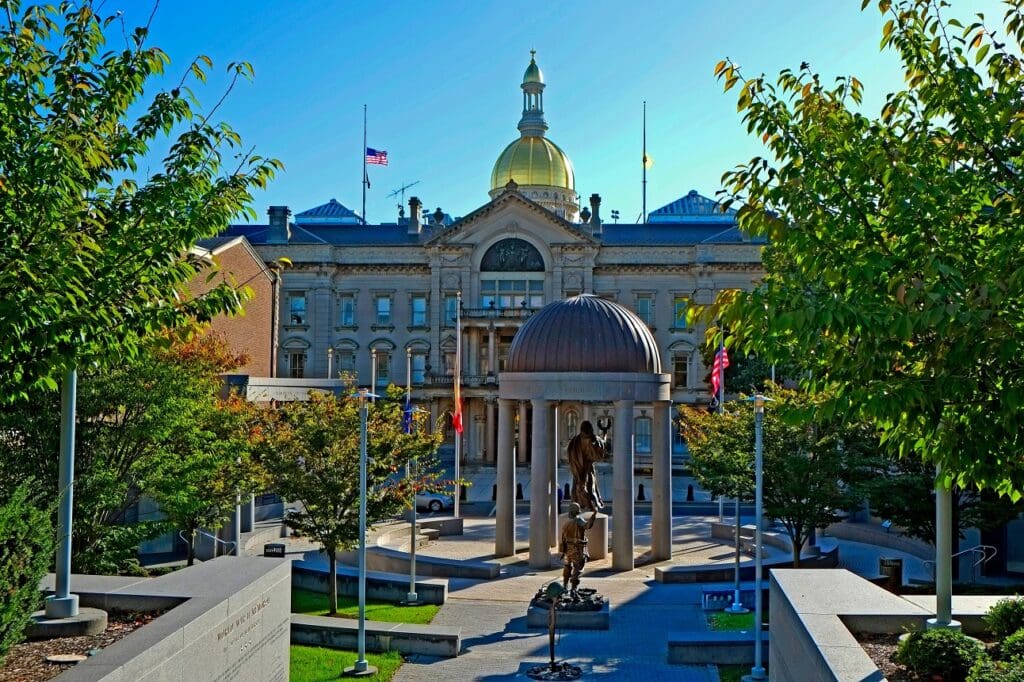

Rumors are swirling in Trenton that New Jersey could see its sales tax rise to 7% as the lame-duck session carries on. Republican leaders warn that Democrats may push a tax increase before Governor-elect Mikie Sherrill takes office, despite her team signaling strong opposition.

New Jersey’s 6.625% sales tax is already among the highest in the nation, generating upwards of $14 billion annually. New Jersey also sees the highest property taxes in the nation.

Raising the NJ sales tax to 7% would restore the rate in place before cuts were made in 2016—adding pressure to residents already facing high property taxes and a high cost of living.

Voter sentiment is clear: vast majorities across party lines oppose a sales tax hike of any amount. Polls conducted by Rutgers show over half of likely voters reject restoring the 7% rate, with opposition intensifying against increases beyond that.

Republican lawmakers in Trenton have proposed legislation to lower the rate to 6%, framing it as a measure to uphold election promises on affordability. The proposal remains pending in both chambers. Republican Assemblyman Christopher DePhillips has called on Governor-elect Mikie Sherrill to go on the record to denounce sales tax hike rumors, according to Insider NJ.

The debate comes amid a looming structural deficit and questions about the state budget’s future. As the lame-duck period unfolds, New Jersey faces a critical choice: maintain high taxes or signal fiscal restraint before a new administration begins.

The New Jersey Digest is a new jersey magazine that has chronicled daily life in the Garden State for over 10 years.

- Staffhttps://thedigestonline.com/author/thedigeststaff/

- Staffhttps://thedigestonline.com/author/thedigeststaff/

- Staffhttps://thedigestonline.com/author/thedigeststaff/

- Staffhttps://thedigestonline.com/author/thedigeststaff/